Student Loan Software for Financial Advisors

The student loan lifecycle platform trusted by financial planners, college financial consultants, independent education consultants, and credentialed professionals including CFPs, CPAs, CCFCs and CSLPs.

Have Confidence in Every Recommendation

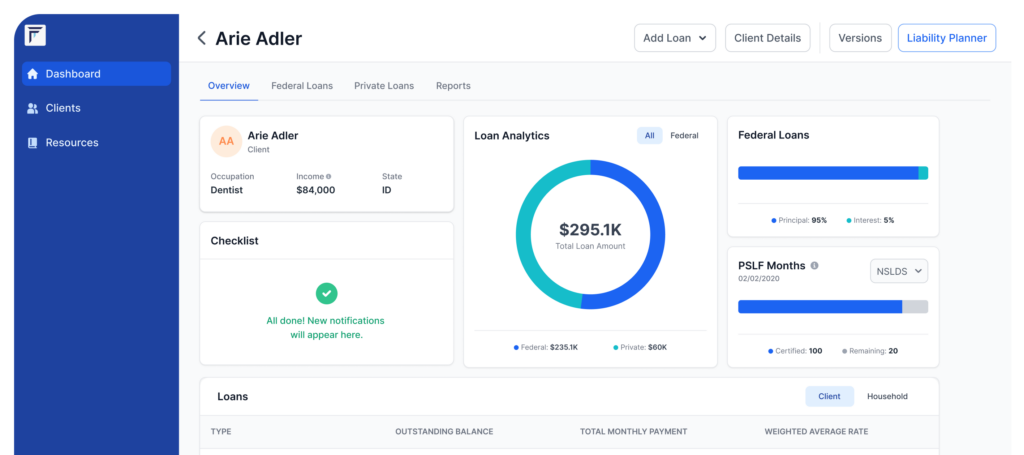

Finology Software empowers financial advisors with the tools that make student loan repayment planning, forgiveness tracking, and debt analysis fast, accurate, and client-ready.

Seamlessly Onboard Client Student Loan Data

Seamlessly retrieve federal student loan information through direct integration with the National Student Loan Data System (NSLDS), eliminating the need for any manual data entry by users.

Simple Planning and Comparing up to four IDR Plans Scenarios

Input clients’ financial details and instantly generate side-by-side comparisons of Income-Driven Repayment plans to easily identify optimal repayment plan.

Offer Compliant Client Ready Reports

With our Liability Planner tool you can quit on manual calculations and easily analyse optimal repayment plan, track forgiveness eligibility and save outcomes for later use.

What advisors say

End-to-end student loan software that helps CFPs, CCFCs and CSLPs plan, simulate, and optimize repayment strategies guiding clients through every stage of their loan journey.

Powerful features tailored to your needs

Finology Software empowers financial professionals with intuitive tools

for student loan management and client success.

NSLDS-Compatible Automation

Use National Student Loan Data System (NSLDS) outputs to auto-fill data into your Finology environment. Streamline workflows and ensure compliance effortlessly.

Track & Analyze Federal Loans

Our secure Liability Planner tool tracks and analyze federal student loan data, and helps build repayment scenarios and track progress toward PSLF.

Compare IDR Plans Easily

Run side-by-side comparisons of Income-Driven Repayment (IDR) plans to find the most cost-effective option based on income, family size, and tax status.

Private Loan Tools

Visualize interest impacts and explore accelerated payoff strategies for private loans. Help clients minimize costs and reach financial freedom sooner.

Custom Client Reports

Automatically populate client loan lifecycle reports. Fully customizable, with personalized notes, these reports are ready for white-labeling, offering clear, professional insights.

In-App Learning Hub

Easily learn about Finology Software through our knowledge base. Access videos, assumptions, FAQs, and a glossary to maximize your understanding of our features.

Student Loan Advising Starts Here

End-to-end student loan software that helps CFPs, CCFCs and CSLPs plan, simulate, and optimize repayment strategies guiding clients through every stage of their loan journey.

No credit card required.

Book a Demo to See Finology Software in Action

Let us walk you through how Finology Software empowers advisors to work smarter, faster, and with greater confidence. Book your personalized demo today.

Frequently Asked Questions

Find answers to some of the most common questions here. For more information, you can visit our full FAQ page.

What is Finology Software and how does it work?

Finology Software is a financial technology platform that empowers financial advisors (and individuals) with tools to manage student loan repayment and personal debt. It helps simulate repayment options and recommends smart forgiveness strategies.

Can Finology Software simulate different repayment and forgiveness options?

Yes. It supports Income-Driven Repayment (IDR) plans, including SAVE, PAYE, REPAYE, and tracks eligibility for programs like Public Service Loan Forgiveness (PSLF).

How do I get started with Finology Software?

New users can begin with a 7-day free trial (credit card required). After that, annual subscriptions start at $1,000/year. A simplified version is also available starting at $99 for individuals.

What are the key features of Finology Software?

Features include seamless NSLDS data import, federal loan simulations, IDR comparison tools, advanced planning with pro forma income scenarios, and PSLF tracking—all designed for accurate, personalized advice.

How secure is my data on Finology Software?

Finology uses high-standard encryption and complies with SOC2 through its public cloud provider to protect all client data and maintain privacy.