Finology Software released a new enhancement to its suite of financial planning tools in June, providing financial advisors with a more comprehensive and user-friendly solution for helping clients manage federal student debt planning and repayment, in addition to other liabilities.

IDR Comparison: A New Horizon in Student Loan Repayment Planning

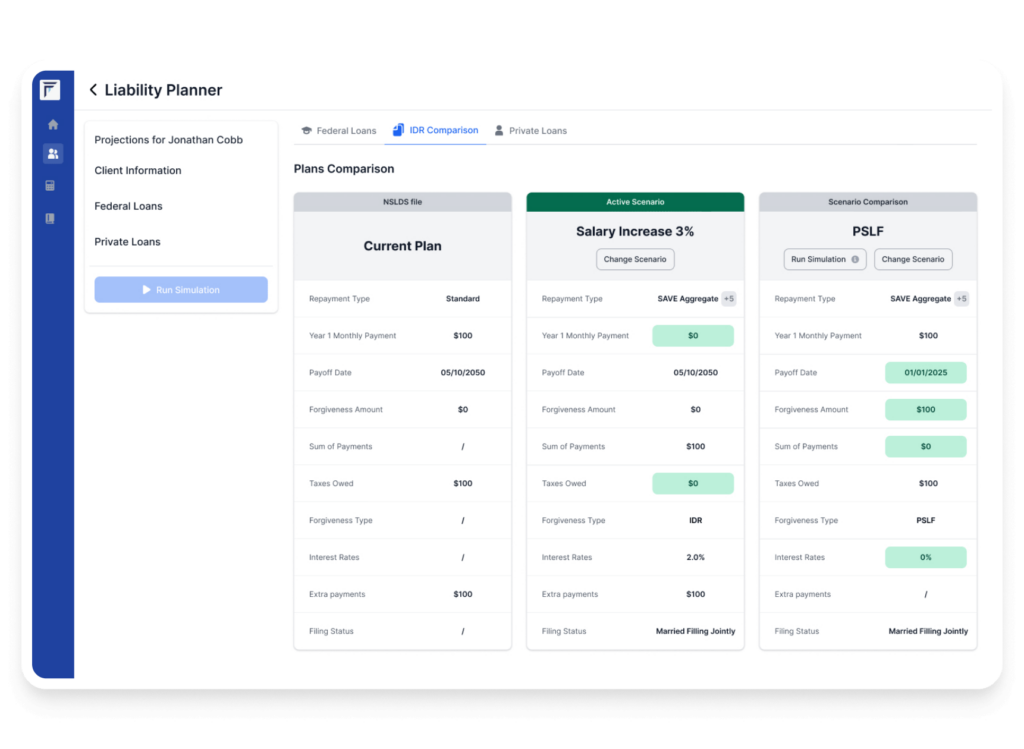

The latest addition to Finology Software’s Liability Planner (formerly Calculator) offering is the IDR Comparison tool. This innovative tool is specifically designed to help advisors navigate and compare the intricacies of the available federal student loan repayment plans to help their clients map their best path to improved financial wellness.

Today’s Income-Driven Repayment (IDR) plans carry a variety of repayment Scenarios depending on the unique situations of specific clients, including marital status, employment status, income, and tax status. The differences between repayment options can be subtle, and having a comprehensive tool you can trust to easily model those scenarios can significantly enhance your ability to provide your clients with the most financially advantageous advice.

Built by student loan and consumer debt specialists, Finology Software’s platform makes it easy to view and analyze repayment options. The new IDR Comparison tool simplifies this process by allowing users to access stored Scenarios within the Finology Software Federal Loan Simulator to produce side-by-side comparisons based on various inputs related to income, repayment plan, family size, tax status, and forgiveness throughout the proforma lifecycle and future years.

Key features of the IDR Comparison include:

- Comprehensive Plan Analysis: Advisors can input their clients’ income and loan information to receive a detailed analysis of how different IDR plans and Scenarios will impact federal student loan repayment.

- Projection of Costs: The tool projects the total repayment amount, monthly payments, and potential forgiveness amounts under each plan, providing a clear picture of the long-term financial implications.

- User-Friendly Interface: The tool’s intuitive design makes it easy for users to navigate and understand their options and compare the data from the current NSLDS file, an Active Scenario, and one additional Scenario per client/spouse.

By using the IDR Comparison Tool, knowledgeable financial advisors can make informed decisions that align with clients’ financial goals. This could potentially save thousands of dollars over the life of their loans and free up investable assets to enhance long-term financial wellness.

Liability Planner: A Reimagined Approach to Managing Debt

In addition to the new IDR Comparison Tool, Finology Software has also revamped its existing Calculator, now called Federal Loan Simulator within the Liability Planner. Liability Planner offers a robust set of specific capabilities for managing various types of debt and liabilities, including non-federal loans and consumer credit card debt.

The New Liability Planner includes the following features:

- New User Interface to easily tab through the tools, within Liability Planner: Federal Loan Simulator, IDR Comparison and Private Loan Planner within the enhancement that reflects Finology Software’s commitment to a crisp and easy-to-use platform.

- Holistic Client Information: After entering client information, advisors are able to see that data in various tabs and tools, allowing easy views of federal student loan debt, private loans, mortgages, credit cards, and personal loans all on one platform.

- Monthly Payment Chart, which allows users to see consolidated client loan balances and future monthly payments.

Sign up for a Free 7-Day Trial Today

Try out Finology Software risk-free for 7 days and see firsthand how easy it can be to help your clients achieve greater financial wellness.