Student Loan Advice Powered by Real Data

Compare repayment plans, model future scenarios, track forgiveness, and import actual loan data in a matter of seconds. It is quick, precise, and designed to give you complete confidence when providing clients with concise answers.

Federal Loans

TOTAL

$109,020

WEIGHTED AVEREGE

6,7%

All Balances

TOTAL

$152,330

WEIGHTED AVEREGE

9,5%

All your clients. All their federal debt. One command center.

Centralize your client’s loan data to stay proactive, respond faster, and prioritize what matters most.

Balance Overview and Client Activity

Instantly view total balances and averages across federal and private loans, and spot trends across client portfolio.

Have a quick overview of your most recent clients, including a breakdown of their federal and private loans, right where you need it.

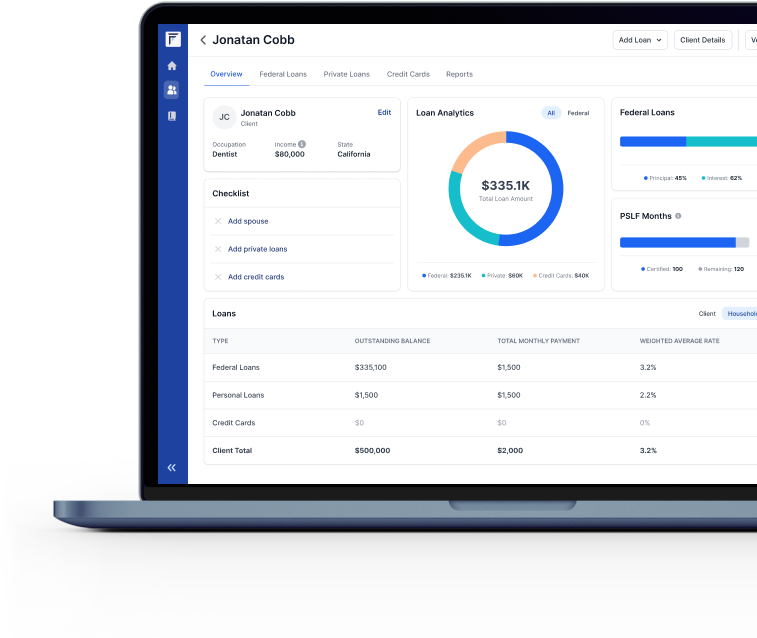

Client Portal for Total Loan Clarity

Use a single, advisor-facing solution to streamline client student loan optimization. Centralize all loan information for confident, transparent planning.

Seamlessly Onboard Student Loan Data

Finology’s direct NSLDS integration allows you to safely import federal student loan data in a matter of seconds. Manual entry is supported too, with error-reducing built-in validation.

Follow Repayment Progress in Real Time

Track your clients’ progress toward income-driven repayment or forgiveness objectives. Finology Software automatically monitors PSLF milestones, eligibility, and payment status.

See the Full Household Picture

Compile all of the household’s federal loans, including spousal loans, into a centralized dashboard. When modeling repayment plans, take family size, income, and filing status into consideration.

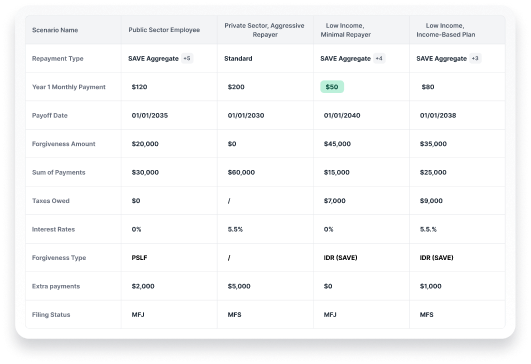

Model. Compare. Decide.

Liability Planner tools let you look into the future with client federal debt. Model different scenarios of federal loan repayment, and compare paths to help your client move forward with clarity.

“What Happens If...?”

Now You Have the Answer.

Create, evaluate, and save several repayment plans for each client in a flash. Examine potential outcomes and strengthen your suggestions.

- Switch between versions for modeling alternative strategies with varying incomes, household sizes, or career paths.

- Synchronize scenarios with NSLDS and PSLF tracking automatically.

- Save all versions and scenarios inside it for future review, compliance, or audit trails.

Have side-by-side Clarity With IDR Plan Comparison Tool.

Project the long-term effects of each income-driven repayment (IDR) plan by comparing up to four of them simultaneously.

By modeling scenarios using current or pro forma income, Liability Planner tool helps clients understand not only today’s payments but also the results of tomorrow.

- Project total cost and forgiveness potential

- Forecast monthly payments and lifetime interest

- Provide clients with data-backed assurance in any income situation

Run Real-Time Projections With Federal Loan Simulator

Using loan data, the Federal Loan Simulator allows you to create realistic repayment scenarios without making any assumptions.

See how a client’s changes will affect their future payments and eligibility for forgiveness, regardless of whether they are changing plans, changing jobs, or filing taxes in a different way.

- Prevent costly surprises at forgiveness

- Spot potential tax bomb risks early and plan ahead

- Deliver lifecycle-based advice your clients can trust

Reports That Speak for You

Convert complex repayment plans into individualized, understandable deliverables. You’ll have a polished, legal report ready in seconds, regardless of whether your client needs a quick overview or a comprehensive plan.

Personalized + Branded

Incorporate your company’s logo, advisor credentials, and client-specific information automatically.

Transparent Assumptions

Every report includes income, family size, and growth rate assumptions to ensure clarity and trust.

Visual Predictions

Show monthly payments, total projected forgiveness, and any possible tax ramifications (also known as the “tax bomb”) using charts and tables.

Real Scenarios. Real Numbers

Compare repayment plans side by side. Use real loan data to illustrate each option’s impact so that clients can see the difference in dollars rather than just theory.

Compliance-Ready

Documentation Each report is structured to support audit trails and regulatory requirements, making it easy to document advice and demonstrate due diligence to maintain client trust.

Action-Oriented

Summarize key recommendations and next steps to guide clients make well-informed choices.

See Finology Software in Action

Let us walk you through how Finology Software empowers advisors to work smarter, faster, and with greater confidence. Book your personalized demo today.

Resources & In-App Learning Hub

Whether you’re onboarding your first client or exploring advanced features, Finology’s built-in learning hub gives you quick access to the resources, tools, and help from our support that keep you moving forward.

Video Walkthroughs

Step-by-step videos that show you exactly how to use Finology. No guesswork, no setup stress, we are here to help.

Video Walkthroughs

Detailed documentation of income, forgiveness, taxes and other assumptions behind every calculation.

Templates & Documents

Access client-ready templates, white papers, and checklists to streamline your workflow and boost compliance.

Glossary of Teams

Access definitions of key terms like IDR, capitalisation, and PSLF so you and your clients stay on the same page.

Frequently Asked Questions

Find answers to some of the most common questions here. For more information, you can visit our full FAQ page.

What is Finology Software and how does it work?

Finology Software is a financial technology platform that empowers financial advisors (and individuals) with tools to manage student loan repayment and personal debt. It helps simulate repayment options and recommends smart forgiveness strategies.

Can Finology Software simulate different repayment and forgiveness options?

Yes. It supports Income-Driven Repayment (IDR) plans, including SAVE, PAYE, REPAYE, and tracks eligibility for programs like Public Service Loan Forgiveness (PSLF).

How do I get started with Finology Software?

New users can begin with a 7-day free trial (credit card required). After that, annual subscriptions start at $1,000/year. A simplified version is also available starting at $99 for individuals.

What are the key features of Finology Software?

Features include seamless NSLDS data import, federal loan simulations, IDR comparison tools, advanced planning with pro forma income scenarios, and PSLF tracking—all designed for accurate, personalized advice.

How secure is my data on Finology Software?

Finology uses high-standard encryption and complies with SOC2 through its public cloud provider to protect all client data and maintain privacy.